Connect to your banks and ERPs all over the world

Finally. One place for all your banks, ERPs and business tools.

The missing piece in your Finance stack

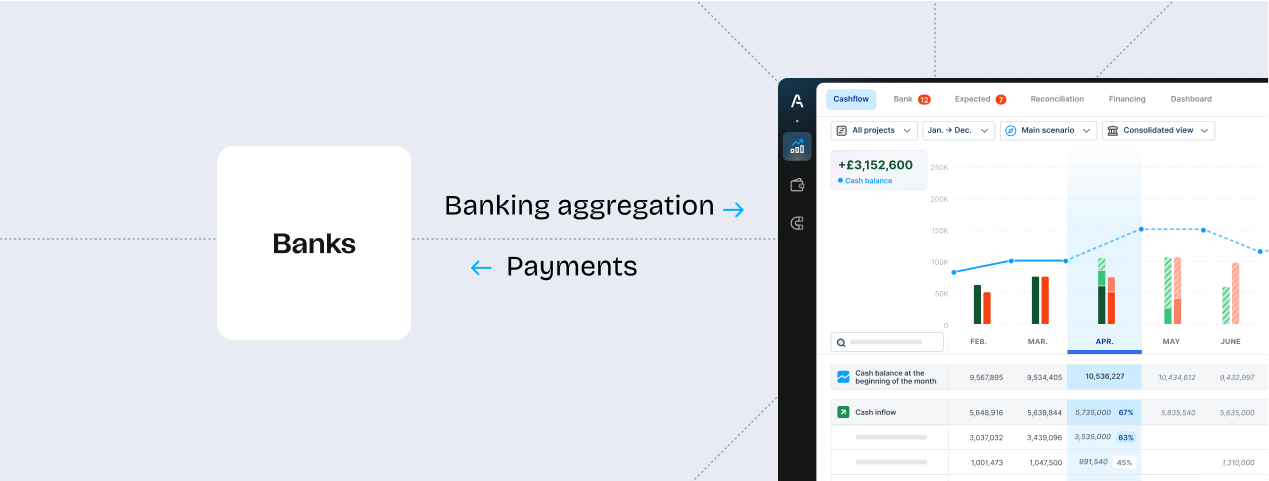

Connected banking is so much better

Get a live view of all your bank data. Make payments globally, across currencies and protocols. All from one interface.

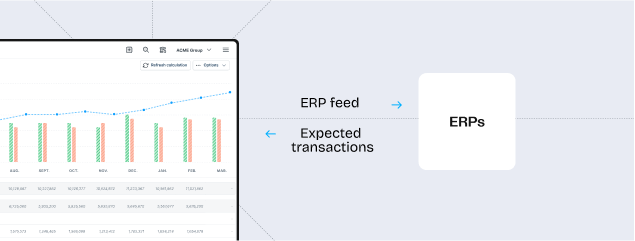

Better EPR connectivity

Pull in expected transactions. Export statements, sync payment files, and send bank, sales and purchase journal in just a few clicks.

Bring all your bank data together. Pay from anywhere, in any currency, at any time.

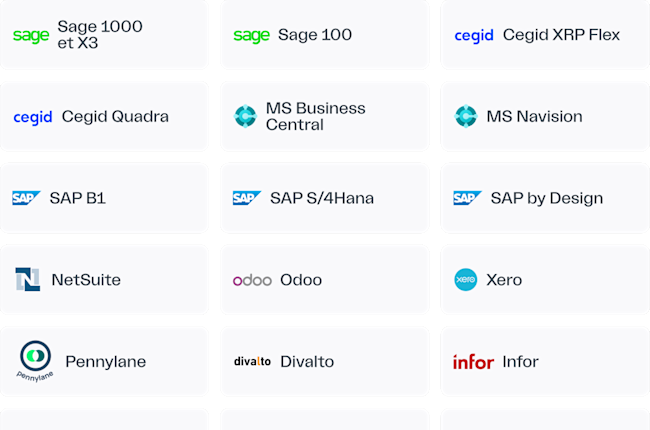

Connect to the tools you already use

Agicap enables two-way data sync with your systems through API or SFTP. There’s no need to leave the tools you like using.

Over 400 ERPs already connected

And hundreds more tools your teams rely on

Our API

Build your own connectors between Agicap and your tools. Enjoy full access to our public API.

Discover how our platform can power your treasury

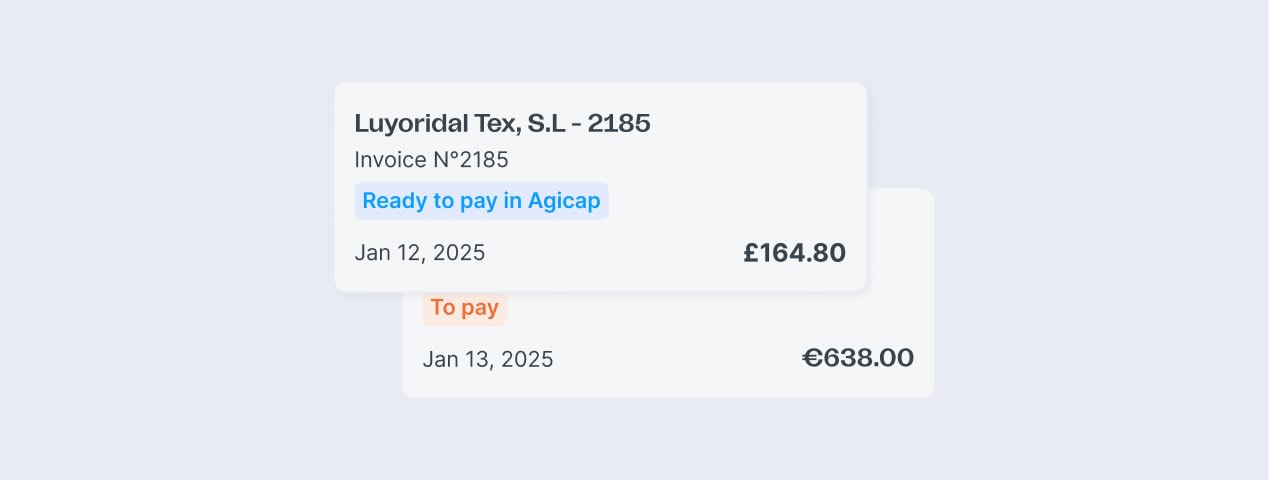

Streamlined accounts payable management

Automate your purchasing workflows. Stay in control of your spending. Create reliable forecast with 360-degree visibility.

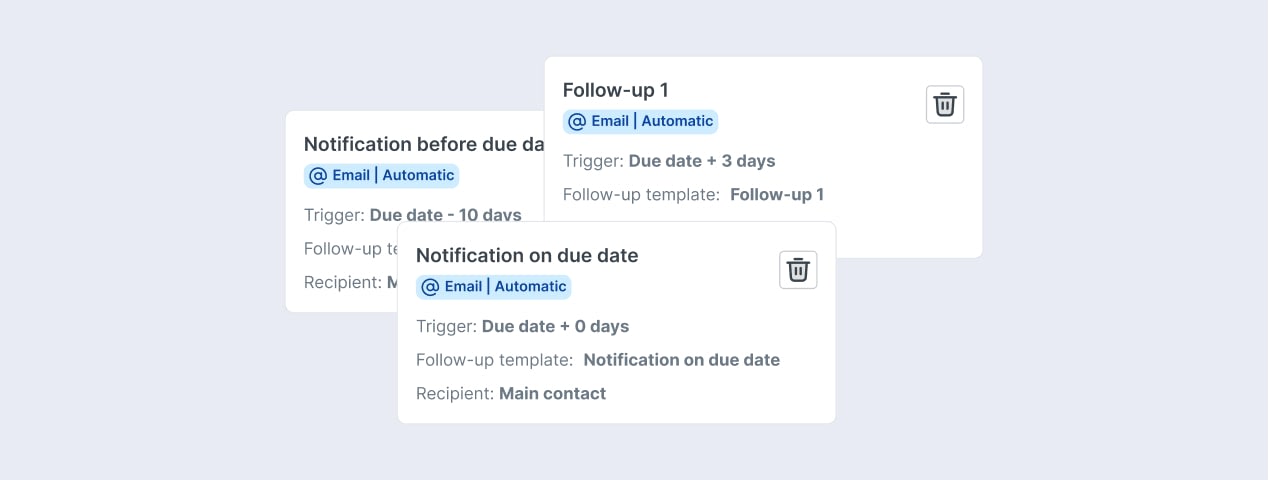

Impactful accounts receivable management

Automate customer reminders. Get paid faster and effortless. Improve collection and reduce DSO.

Seamless payments

Make secure payments through one single platform. Execute transactions around the world in all your currencies. Don't juggle different passwords for different bank accounts anymore.

Integrated treasury management

Connect, forecast and optimise your cash flow precisely.

Frequently Asked Questions

What is a Banking Connectivity Software ?

A bank communication and ERP software automates exchanges between a company and its banks, optimizing payments, bank reconciliation, and cash management. It secures transactions through protocols like EBICS and integrates with ERPs to centralize financial flows.

Agicap is the specialized cash management solution, enabling businesses to control their corporate finances in real time with automated bank connections and accurate forecasts.

Ask a demo

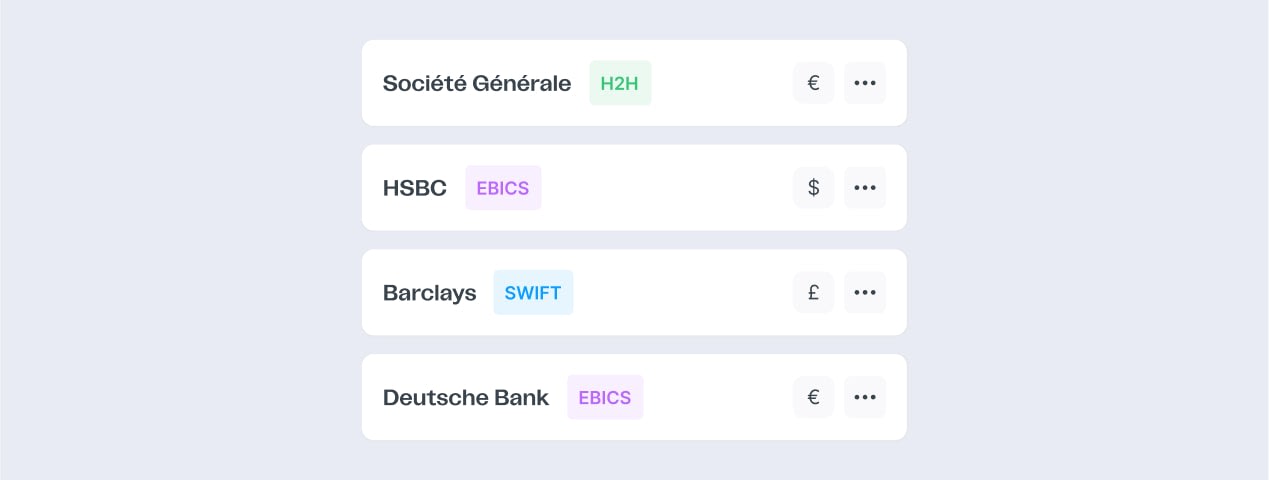

What protocols does Agicap support for banking connectivity ?

Agicap supports multiple bank connectivity protocols to ensure secure and efficient communication with financial institutions.

Among the supported protocols are:

- EBICS (Electronic Banking Internet Communication Standard)

- SWIFT (Society for Worldwide Interbank Financial Telecommunication)

- SFTP (Secure File Transfer Protocol)

- Host-to-Host (H2H)

These protocols enable seamless integration, ensuring reliable financial transactions and optimized treasury management.

How does the secure connection between bank and ERP work with Agicap ?

Agicap ensures a secure connection between your banks and ERP system by utilizing standardized and secure banking communication protocols, such as EBICS, SWIFT, Host-to-Host, and SFTP. These protocols guarantee the confidentiality and integrity of exchanged data.

Seamless ERP integration is facilitated through the use of APIs, SFTP connections, and OpenAPI, enabling automated and secure financial data transfers between your banking systems and ERP.

How does data transfer with my ERP system work via Agicap ?

Agicap synchronizes your financial data with your ERP via API, SFTP, and OpenAPI. This secure connection enables the automatic transfer of bank transactions, invoices, and cash flow forecasts, eliminating manual entries and reducing errors. Updates are sent in real-time, ensuring a smooth and reliable management of financial flows. The result: time savings, increased accuracy, and instant cash flow visibility.

Consult our resources

Article

Coping with the Complexity of Banking Connectivity: How to Bridge Your ERP to Your Banks

How to Implement an ERP Faster with Banking Connectivity as a Service

How to Leverage Banking Connectivity in Your Finance Teams

Ebook

Building better Connectivity bewteen banks and ERPs

Masterclass

Video Masterclass : Boosting Your ERP with Banking Connectivity