Get paid faster with zero hassle

Agicap automates all your customer payment reminders so that you can accelerate your collection and stay on top of your accounts receivable.

Automated collection

Limited manual work due to intelligent automation

Centralised team collaboration

All interactions in one unified interface

Customer risk analysis and DSO monitoring

Tailored credit policy adjustments

Track your DSO in real time

Monitor key accounts receivable metrics

You'll always have a real-time view of your DSO, aging balance, and any outstanding receivables. Don't let those late payers slip under the radar.

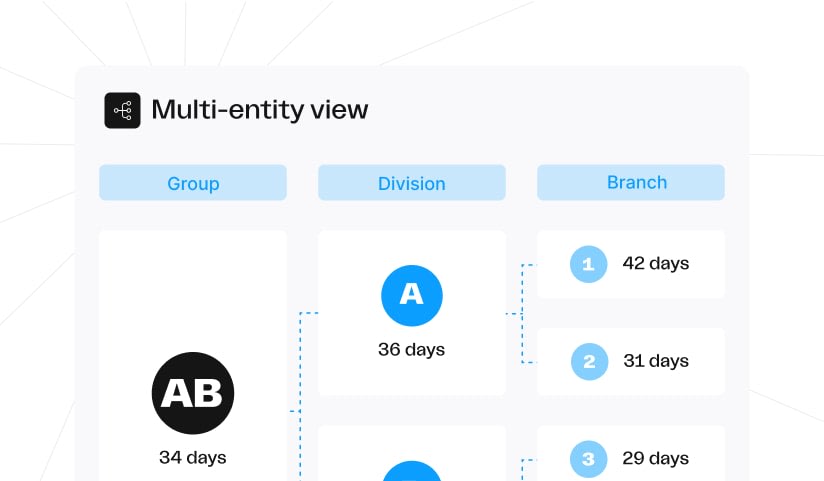

Consolidate data at group level

Monitor your group's DSO with automatic consolidation of key performance indicators.

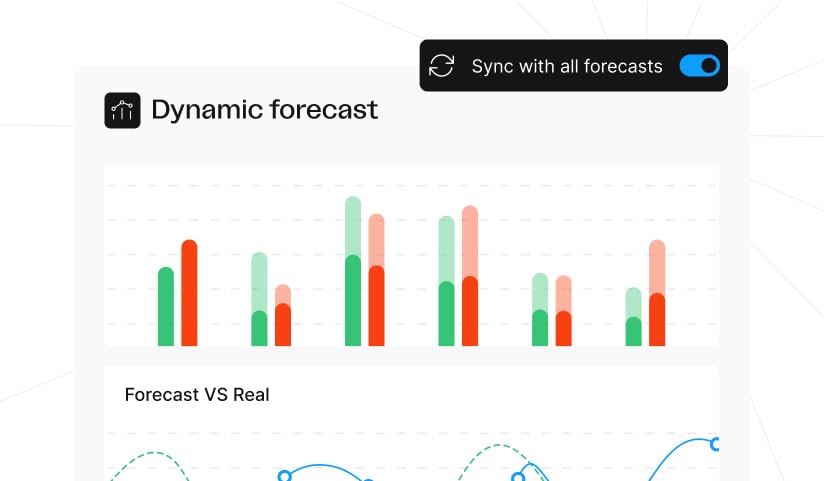

Integrate your forecasting

Strengthen your cash flow forecast by syncing real DSO data for each customer.

Improve your collection performance

Automatic invoice capture

Easily connect your ERP and business tools via API or SFTP. Automatically import invoices, client details and contact information so nothing gets lost.

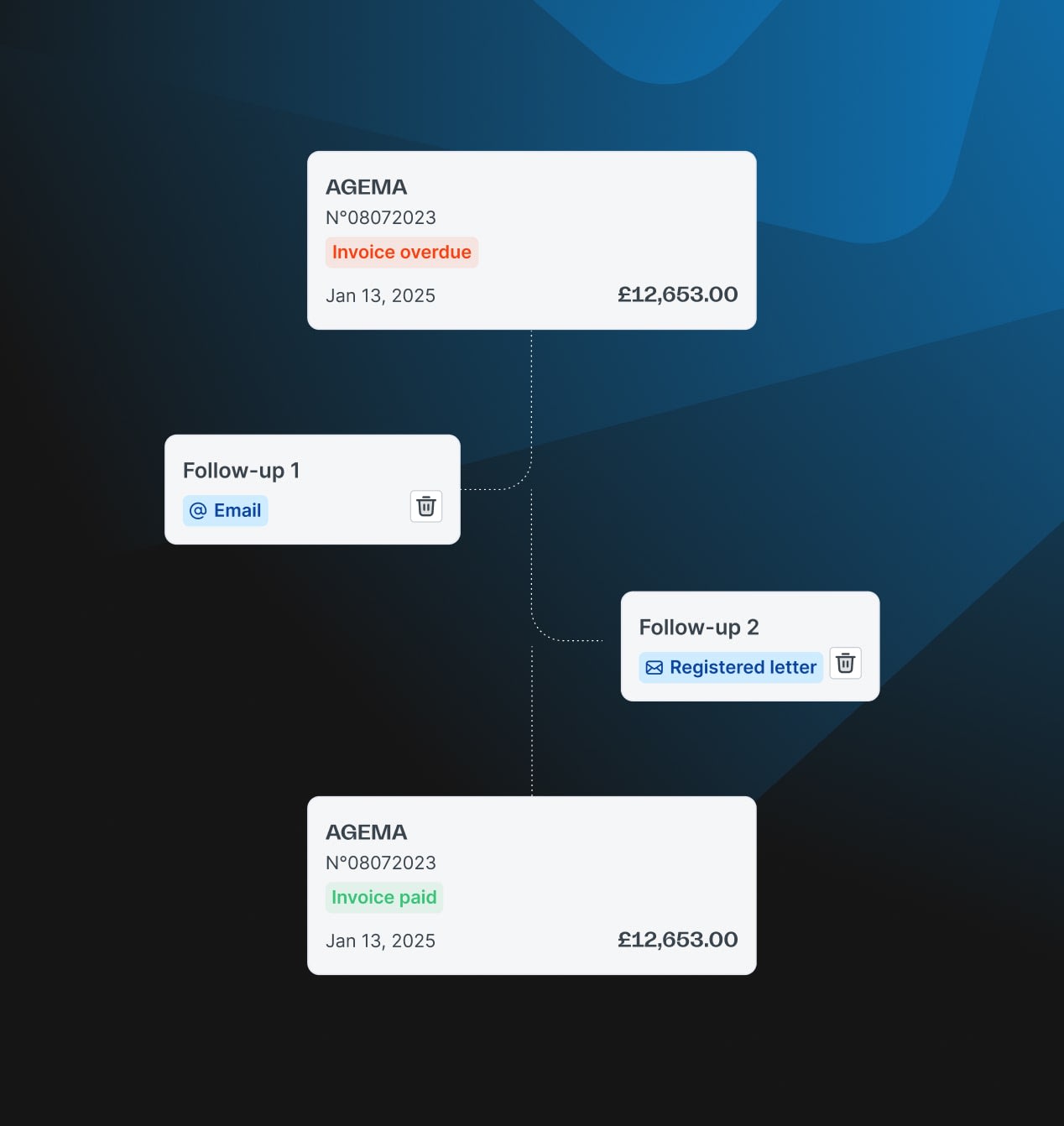

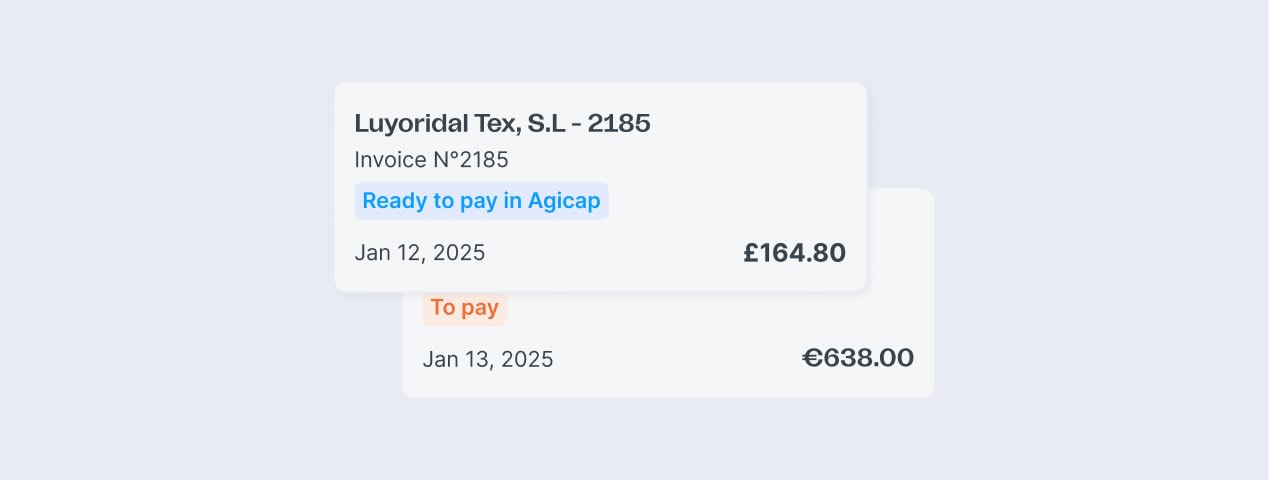

Automated customer reminders

No more awkward conversations. Streamline your collection with automated, customisable reminders sent via email or recorded delivery. Use a pre-built template, include a payment link, and manage everything from the same interface.

Dispute management

Flag any disputed invoices to temporarily pause automated reminders until the issue is resolved.

Customer risk monitoring

Set credit limits for each client to manage your financial risk more effectively.

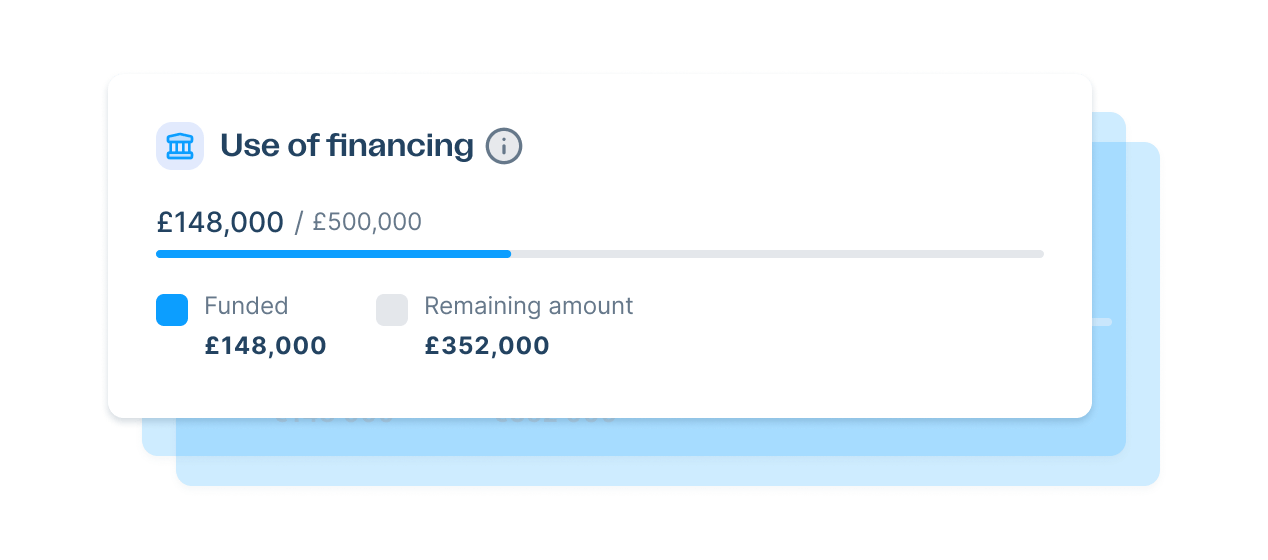

Modeling the impact of receivables financing on your treasury has never been easier

Centralise the terms of all your invoice financing agreements.

Automatically match customer invoices to the right financing solution.

Instantly calculate expected payment amounts and dates for lenders and clients.

Close faster, with confidence

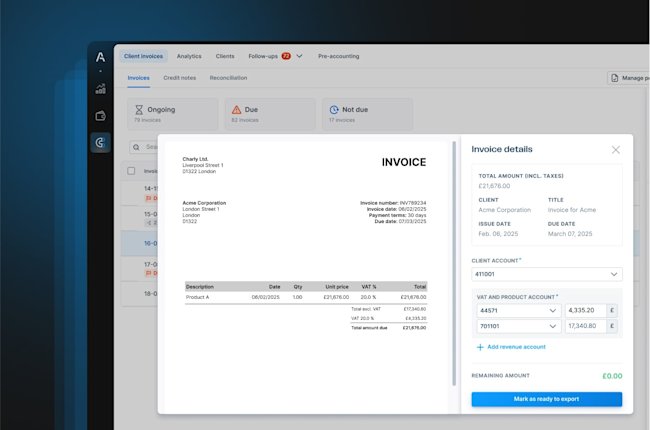

Generate your sales journal with ease

Import your chart of accounts, link invoices to the right accounts, and export your accounting entries to your ERP - all in just one click.

Discover how our platform can power your treasury

Streamlined accounts payable management

Automate your purchasing workflows. Stay in control of your spending. Create reliable forecast with 360-degree visibility.

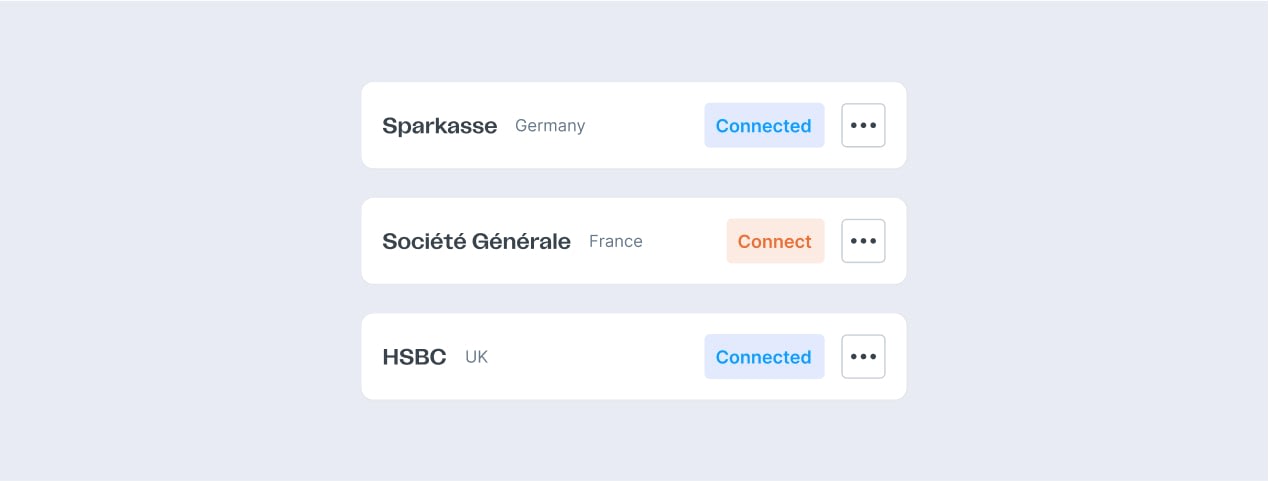

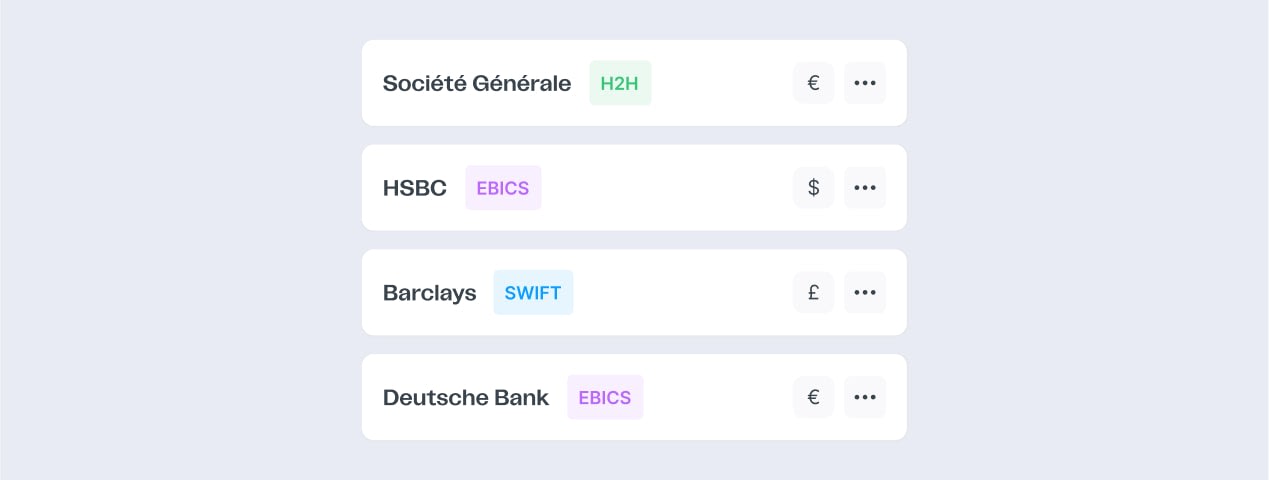

Improved connectivity

Connect all your banks and ERP systems. Benefit from a single source of truth and and easily sync data with your finance tools.

Seamless payments

Make secure payments through one single platform. Execute transactions around the world in all your currencies. Don't juggle different passwords for different bank accounts anymore.

Integrated treasury management

Connect, forecast and optimise your cash flow precisely.

Frequently asked questions

What is account receivables automation software ? (dunning software)

Customer dunning and account receivables software automates the tracking of unpaid invoices and optimizes dispute management to speed up debt recovery. It helps to identify and process disputed invoices separately, while ensuring accurate tracking of their resolution to improve cash flow.

By integrating with accounting and ERP tools, Agicap facilitates dunning management and cash flow forecasting, thanks to data updated in real time.

Request a demo

What are the main features of an account receivables automation software ?

1. Receivables Management: Efficient tracking and management of customer invoices and payments.

2. Automated Follow-ups: Automated reminders and follow-ups for overdue payments to improve cash flow.

3. User Rights Management: Control over user access and permissions for secure operations.

4. Analytics and Reporting: Comprehensive analytics and reporting tools for better decision-making.

5. Consolidation: Ability to consolidate data across multiple entities for a unified view.

How to use dunning software like Agicap effectively ?

To effectively follow up with a customer, you need to seize the momentum. It's important not to wait for the due date (30-60 days after receipt of goods/services).

To do this, we advise you to never lose the customer-supplier relationship, by communicating as often and as healthily as possible.

We advise you to set up a reminder/collection routine (on a specific day of the week, for example), and to use the software alongside telephone calls to collect the largest invoices, or the most volatile outstanding amounts, for example.

How to set up account receivables management at Agicap ?

Here's the full integration documentation for implementing Agicap's dunning management in your company.

Full support is included in your onbarding.

Don't hesitate to ask our teams for a demo.